What do you really need as an advisor?

Make cold conversation warm

AffordX empowers you to share data-driven insights with your clients, transforming cold, uncertain conversations into warm, informed ones. This allows you to establish credibility and build stronger client relationships from the very beginning.

Improve conversion rate

Now that you’ve earned your client’s trust. With intuitive workflows and guided explanations, clients feel more confident throughout the process—leading to deeper engagement, less friction, and higher conversion rates for you.

Shorten submission time

AffordX takes the hassle out of paperwork by automating income and expense analysis, saving you time and reducing errors. Our smart tools also generate clear, structured diary notes from client interactions so you can stay focused on advice, not admin.

Helping people get a mortgage is hard, AffordX makes it easier.

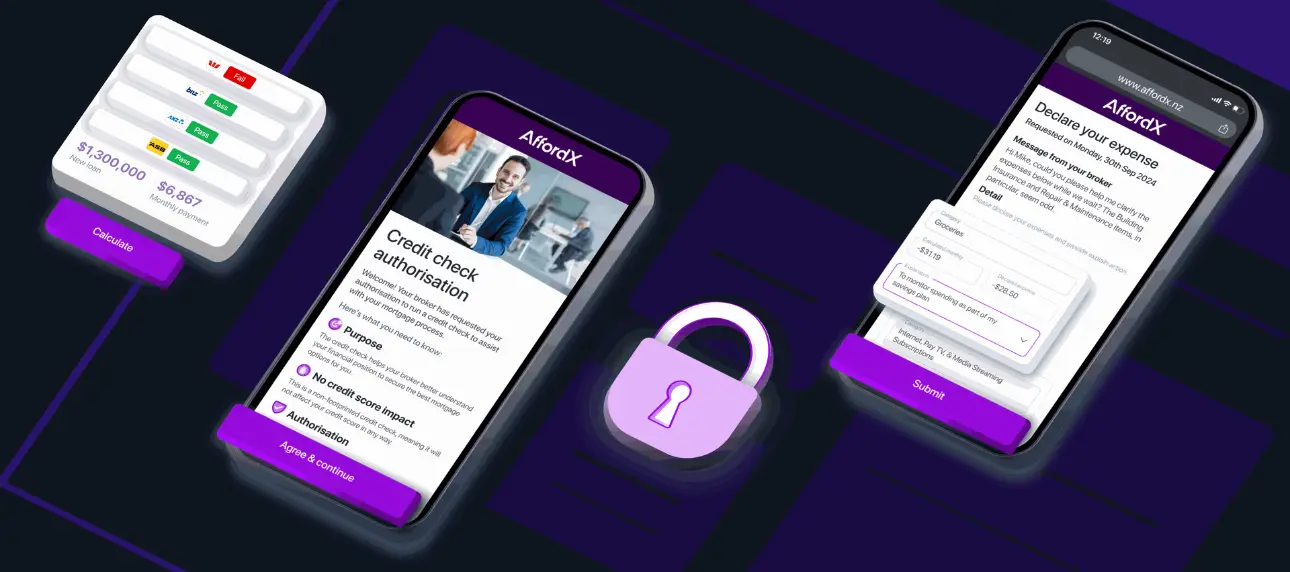

Superb consumer experience

Delivering a great customer experience is essential for your success as a mortgage broker.

That’s why our platform is built with both you and your clients in mind, ensuring every interaction is seamless, efficient, and stress-free.

From intuitive user interfaces to real-time support, we’re here to help you create lasting relationships with your clients.

Simplified advisor workflow

AffordX helps you deliver fast and precise assessments to your clients, making the mortgage process smoother for everyone involved.

Our platform is designed to help advisors like you work more efficiently, with data-driven insights that improve client confidence and decision-making.

AI features? Yes you're in safe hands.

We use secured, privately hosted AI models to automate your workflow.

Tired of writing diary notes especially when you already know what needs to be written? Let AffordX do the heavy lifting.

All the tools you need, in one place

Tired of juggling multiple platforms to complete affordability assessments? AffordX has you covered.

From credit checks to property reports, AffordX brings all the essential services you need into one seamless platform.

Say goodbye to switching between systems and hello to efficiency.

Build a trusted relationship

with your client

With AffordX, you foster relationships based on confidence and long-term loyalty.

AffordX helps you build trust with your clients by offering transparency, accuracy, and secure data handling.

Our platform provides clear, data-driven affordability assessments that your clients can rely on, ensuring you become their go-to advisor.

Built for brokers by brokers

Designed to be loved!

From encrypted data handling to secure banking integrations, every element of our platform is designed with your clients' protection in mind.

You can rely on us to safeguard the information that matters most.

4 EASY STEPS

to complete affordability assessment